SUMMARY OF ALL SP500 UPTRENDS AND CONSOLIDATIONS

THANKS TO YOU ALL-MY PAGEVIEWS SKYROCKETED IN JAN2012,ONE MONTH ALONE is EQUAL TO 6MONTHS OF

PAGEVIEWS!!A BIG THANK YOU

SINCE THIS THREAD "SUMMARY OF ALL SP500 UPTRENDS AND CONSOLIDATIONS" THREAD IS SO POPULAR,THE HIGHEST VIEWERSHIP,I PUT IT IN THE FRONT PAGE

SUMMARY OF ALL SP500 uptrends and consolidations

UPTRENDS-

1. Mostly 10weeks,although some may be 9,11,12.how to recognize?--uptrend "mysteriously" maintained by a diagonal uptrendline connecting the lows of that 10weeks uptrend

2. 1st and last(10th) week always end in surges of aorund 3-6%with the least 1st week gain was 2.7%.The humpy uptrend will "mysteriously" start and end with surges up.

3. If the (X-1)th 10+weeks end below a fibo of the 1576-666 range,THEN the next,Xth, 10+weeks will end AT THAT FIBO.

4. If the (X-1)th 10+weeks end ABOVE a fibo of the 1576-666 range,then the NEXT,Xth, 10+weeks will end AT THE NEXT HIGHER FIBO.

5. Every year's end, at the last trading day of the year,sp500 will end near a fibo of 1576-666 range.

6. Every 10+weeks uptrend will start AFTER a double testing of the diagonal uptrend line formed by the humps from july 13th week 2009.

7. The uptrend in the secular bear market,before breakout 1576, will be a "humpy" ride,whereby i forecast a total of 4 humps to test 1576.

8. After the sp500 breaks out of the 1576 resistance,the diagonal uptrendline will be much sharper than the uptrendline of the 4 humps.

9. The peaks of each hump will occur at AROUND 350-360 POINTS ABOVE THE CORRECTION TESTED FIBONACCI.

10. 2009 REPLICATE 2003,2010 REPLICATE 2004,2011 REPLICATE 2005,SO ON--I mean the closing values and their respective fibo,

CONSOLIDATIONS-CORRECTIONS AND RETRACEMENTS

1. Every correction will have one week of huge plunge about 100points in sp500

2. every Long/HUGE weekly plunge of around 5-8% in the sp500 will be met with a return to the start BEFORE the huge plunge(weekly open) of THAT LONG WEEKLY DOWN CANDLEBODY in 23 to 24 weeks

3. After the peak of each hump has been achieved,there will come a plunge BACK to the fibo of 1576-666 range.---------

eg. 1st hump ended at 1219,near 61.8%,then sp500 plunged back to retest the 38.2%,before the NEXT hump will be formed

eg. 2nd hump peaked at 1370,near the 78.6%,then sp500 plunged back to retest the 50%..so on..

1st correction went to the 38.2%,1013, lowest 1010 and built a base around 1065

-took 24 weeks to reach the open of the HUGE weekly plunge of 120points,week of MAY 3RD 2010

-dropped a total of 210points-2nd week from the top of the 4th 10+weeks uptrend pattern 1217,was the huge weekly plunge

-took 8weeks to hit the lowest point 1010

2nd correction went to 1074 lowest,BUT built a base around the 50% fibo,1120.

-took 23 weeks to reach the open pf the 2nd HUGE weekly plunge of 120points,week of August 1, 2011

-dropped a total of 270points from 1344 and 300points from the HEAD peak 1370

-the huge weekly drop also happened in the 2nd week from the 5th 10+weeks uptrend pattern close peak of 1344.,the LEFT SHOULDER OF THE head and shoulders

-took 9weeks to hit the lowest point 1074

THIS IS THE NEW AND IMPROVISED VERSION OF THE MOST POPULAR POST IN MY BLOG

LET US RECALL THE LIES OF MEDIA OR PEOPLE WHO DON'T KNOW HOW TO EXPLAIN

1)DATA GOOD,COMPANIES EARNINGS GOOD,INDEX DROP= "FACTORED IN" OR "LESSEN STIMULUS HOPES"

2)DATA BAD,COMPANIES EARNINGS BAD,INDEX RISE="INCREASED STIMULUS HOPES"

3)WHEN USA CRISIS CAME,FULL OF CDO SHIT PROBLEM,NO1 KNOWS THERE WILL BE A EUROPE CRISIS IN 2009.THEN CAME EUROPE CRISIS.

4)WHEN EUROPE CRISIS BECOME STALE NEWS,FOCUS SHIFT TO LIBYA GADDAFI TO "EXPLAIN" DROP IN USA MARKETS

5)THEN AFTER GADDAFI NEWS BECAME STALE,THEY SHIFT BACK TO EUROPE AND CHANGE TO "AUSTERITY" SHIT

6)THEN AFTER EURO AUSTERITY NEWS BECOME STALE,THEY SHIFT FOCUS BACK TO USA AND INTRODUCED "FISCAL CLIFF" SHIT JUST BECAUSE BERNANKE MENTIONED FISCAL CLIFF

I "LOVE" THEIR SHIT.EVERYTIME THE STORY BECOMES OLD AND STALE,SOMETHING NEW WILL POP OUT AND THE OLD ONE WILL NEVER BE MENTIONED AGAIN-SINK INTO OBLIVION!!

1ST CDO,LIBYA,AUSTERITY,NOW FISCAL CLIFF.NEXT FUCK YOU!!DID CDO SHIT RESURFACE AGAIN NOW?WHO REMEMBER GADDAFI,LIBYA PROBLEMS SUDDENLY SOLVED FOREVER??

GRANDMOTHER STORY SPINNERS FUCKERS.

19th October 2013

NEPTUNE ORIENT LINES ROBOTIC PATTERN

1) BASE

A-

WEEK oF 17 NOVEMBER 2008—0.93

Week of 9 March 2009—0.85

DOUBLE BOTTOM HIT

3+ MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED +182% IN

1YEAR,1 MONTH, HIT NEAR 2.40 IN APRIL 2010

2) BASE

B-

Week of 22 August 2011—0.98

Week of 21 November 2011---0.995

DOUBLE BOTTOM HIT

3 MONTHS APART BETWEEN

1ST AND 2ND BOTTOM

RALLIED +53% IN 3

months.HIT 1.515 IN 20 FEBRUARY 2012 WEEK

3) BASE

C-

Week of 23 July 2012—1.05

Week of 19 November 2012---1.05

DOUBLE BOTTOM HIT

3+ MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED +30% IN 1.5months.HIT

1.36 IN 7 January 2013 WEEK

4) NOW,IT

IS BASE D TIME

Week of 10 June 2013—1.025

Week of 26 August 2013---1.025

DOUBLE BOTTOM HIT

Near 3 MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED ????% by

??????

N.O.L-NEPTUNE ORIENT LINES-N03.SI (WEEKLY CHARTS) YEAR 2006:6 NOVEMBER TO 1ST JAN2007: 1.77 TO 2.20 (+43c) YEAR 2008:17NOVEMBER TO 5JAN2009: 0.84 TO 1.175 (+33.5c) YEAR 2009:2NOVEMBER TO 11JAN2010: 1.51 TO 1.94 (+43c) YEAR 2010:22NOVEMBER TO 3JAN2011: 2.07 TO 2.40 (+33c) YEAR 2011:21NOVEMBER TO 30JAN2012: 0.995 TO 1.43 (+43.5c) YEAR 2012:19NOVEMBER TO 7JAN2013: 1.055 TO 1.36 (+30.5c)

Tuesday, October 30, 2012

30th october 2012-SUPER SUPER RED ALERT!!MY DARLING MERCATOR BOMBAY TODAY SURGED UP 7.6% ONLY AFTER SGX CLOSED.SO TOMORROW ,EXPECT MERCATOR SINGAPORE TO SURGE TO BEYOND 12CENTS

comprehensive quote

र 21.15 INR + 1.50 (7.63%)Monday, October 29, 2012

30th october 2012-hongkong property panic-dropping 10+%(inclusive of "negotiation space",previously don't have) over the weekend

君臨2650萬售 減幅5.4%(hongkong property drop 5-6% on reduced offer price on the news)

其中由韓國人持有的君臨天下3座低層C室單位,昨天以2,650萬元售出,比上周一的開價2,800萬元,減價150萬元,減幅約5.4%。該單位建築面積約1,385平方呎,呎價約1.91萬元,低市價約5%。據悉,該單位原業主於09年以2,104萬元購入上址,持貨至今3年帳面獲利546萬元,升值近30%。

另外,擎天半島6座低層H室單位業主,更將上周三的開價1,500萬元,調低6.7%至1,400萬元放售;而擎天半島5座高層F室單位業主,亦將8月份的開價1,780萬元,調低5.6%至1,680萬元放售. (same scenario,other properties in different area also drop 5-6% on reduced offer price)

港島區豪宅表現更加疲弱,政府針對海外客及公司註冊的買家印花稅(Buyer's Stamp Duty,簡稱BSD)一出,即時令港島豪宅冰封,昨天山頂、南區、中半山、東半山及西半山等傳統豪宅區,均出現零成交的僵局。有代理指,現時業主及買家均持觀望態度,期望再觀察一段時間才作減價或入市等決定。

10大屋苑 兩天12宗成交

至於傳統藍籌屋苑方面,新SSD登場首個周六、日,二手睇樓及成交量全綫急降,據中原統計,10大屋苑上周六、日僅錄得12宗成交,按周減少達43%,為4個月來新低,成交量重回6月的低位;同期利嘉閣10大屋苑錄有21宗成交,按周減少46%。而美聯就10大屋苑錄13宗成交,按周減少逾52%。(10大屋苑中,利嘉閣與中原統計屋苑相同,而美聯選荃灣中心代替前兩者的映灣園。)

無街客 睇樓客急降5成

有地產代理形容過去兩天二手市況是,金融海嘯第二波,大部分二手屋苑租賣兩閒。中原康怡分行首席分區營業經理楊文傑指,「周六、周日,幾乎所有同事無離開過分行,既無街客,預約睇樓客也紛紛甩底,睇樓量急降5成。」(NO STREET CUSTOMERS,NO. OF VIEWERS PLUNGE BY 50%,PROPERTY ANALYSTS DESCRIBE THIS AS FINANCIAL CRISIS 2ND TIDE,MEANING NOW HK PROPERTY IS AS BAD AS DURING SUBPRIME CRISIS)

現市況下,只有減價才能推動買家入市。香港置業分行經理鄭嘉龍指出,大角咀港灣豪庭1座中層E室,面積504平方呎,業主於政府出招當天放盤,當時叫價480萬元,昨日即減價25萬元,以455萬元售出,呎價9,028元。

利嘉閣地產總裁廖偉強指出,兩項辣招短期內會對市場帶來心理影響,目前,一、二手市場均會全面進入觀望狀態,並會維持一段時間。

MY COMMENTS IN RED COLOUR

wah my 16th july 2012 post still haunt me back-shanghai composite revisit the "ghosts" of my 2066

"target for new low in july/august 2012-:2050-2080,TO BE EXACT LOOK OUT FOR 2066"

THE RETURN OF OLD "FRIENDS" ON FRIDAY 26TH OCT 2012-SHANGHAI COMPOSITE WENT BACK TO RETEST MY 2066!!successful defending of here will see shanghai surge to 2600s,of course not in one go.

上证指数

(上证: 000001)- 前收盘 2101.58

- 今开盘 2100.10

- 最 高 2102.16

- 最 低 2058.06

- 振 幅 -1.68%

- 成交量 7860.64万

- 成交额 542.49亿

- 上 涨 100

- 持 平 263

- 下 跌 888

Sunday, October 28, 2012

28th october 2012-LOOK FOR NEXT WEEK AS IST WEEK OF 9TH 10+WEEKS UP SIGNAL

Saturday, October 27, 2012

27th october 2012-haha 1COMPANY CANNOT EVEN AFFECT NASDAQ,CAN AFFECT WHOLE COUNTRY,WHOLE WORLD???

my comments:

(wah!ONE COMPANY AFFECT WHOLE COUNTRY AND WHOLE WORLD SENTIMENT??AS IF!!)

NASDAQ LAST NIGHT EVEN WENT FLATTISHLY UP!!

NASDAQ Composite (^IXIC)

-NasdaqFriday, October 26, 2012

26october 2012-thursday there was no surge,friday us fut down=USA STILL IN RETRACEMENT,NO 1ST WEEK UP THIS WEEK

1)thursday/friday must surge 2%,or thursday and friday must surge a total of >2%

2)usa must not plunge on friday-if usa plunge on friday,GENERALLY it will tell us still in retracement.

3)sp500 1st week up must have overall >2% weekly gains

NOT NEWS.DID YOU SEE I USE ANY NEWS?DID I SAY TONIGHT USMARKET FALL DUE TO APPLE MISS EXPECTATIONS?I SAY LET THE MARKETS TELL US THE ANSWER.WE TRADERS CANNOT CONTROL THE MARKETl,SO PLEASE DO NOT LINK NEWS TO EXPLAIN.STOCKMARKETS MAY RISE ON BAD NEWS.IF MR. MARKET LETS TONIGHT SURGE 30+ POINTS,THEN IT IS 1ST WEEK UP.ANYTHING LESSER,USA IS STILL IN RETRACEMENT

Wednesday, October 24, 2012

24th october 2012-look at majority traders posts in blog-totally SWAYING IN THE WIND

Wednesday, 24 October 2012

"A Divergence in Asia market from US

The more US market drops, the more I expect the market to rise in November. Yesterday US drops by 250 points, the third largest one day drop this year. This is surely not something we expect 3 weeks before the US election. I think President Obama will be concerned with the stock market going into the election.

Research have shown that the probability of the incumbent party will get re-elected only when the stock market does well in the last 2 months before election. So Obama should be sweating over this.

Having said that, we still maintain our view of bullishness in the last quarter. Just that short term, the market seems weak with the poor earnings report from some influential companies. Yesterday was Dupont, one of the industrial companies in Dow Jones 30. Actually there are some companies that show positive earnings and these are ignored by the market. One such company is Facebook.

So my view remains the same for US market, unless Apple issues a positive earnings results that is well received by the market, this lack of market confidence might still continue. Apple has the chance to turn around the market 2moro after market close.(wah!ONE COMPANY AFFECT WHOLE COUNTRY AND WHOLE WORLD SENTIMENT??AS IF!!)

Coming back to the Singapore market, it does seems that STI is diverging from the path of the US market, which is showing remarkable resilience! In fact, Hang Seng, KLCI and Shanghai Composite are all stubborn to follow US market. With US dropping 250 points yesterday, Singapore actually did not drop a lot, today it close 0.7points only.(TRADE SO LONG AND DON'T KNOW THAT RESILIENCE=ALREADY TOLD YOU USA 2,3DAYS LATER WILL RISE AND HAS FACTORED IN USA MAIN INDEX RISE IN THE NEXT FEW DAYS)

It is time to watch some singapore stocks.

Once things get better with US, Singapore market should continue its upwards trend.In my last article, I have noted some Singapore companies for us to study.

If you are conservative, you might want to wait for Thursday Apple earnings to judge. The reason is if Apple fails, it might cause another small panic in US market. (WAIT FOR THIS,WAIT FOR THAT.IF APPLE GOOD TODAY,EXAMPLE CATERPILLAR BAD TOMORROW,HOW?DON'T ENTER STOCKMARKET LAH.DEAR CONSERVATIVE TRADERS,HAVE YOU EVER SEEN MAIN INDEX RALLY ON WEAK EARNINGS AND LOUSY ECONOMIC DATA BEFORE??IF THEY CANNOT EXPLAIN,THEN THEY WILL CALL THE RALLY AS "FAKE",ARTIFICIALLY BOOSTED BY QE3.WHEN IN REALITY,THEY DO NOT KNOW HOW TO EXPLAIN.)

Rgds

Daniel

www.danielloh.com

www.danielloh.com

24th october 2012-SP500 HITTING 1540-1576 IN JAN-FEB2013 IS VERY VERY SIGNIFICANT

1)BY TOUCHING TRIPLE TOP WITH YEARS 2000 AND 2007,STI AND HANGSENG MUST "COINCIDENTALLY" REVISIT THE HIGHEST POINT MADE IN NOVEMBER 2010.

2)MERCATOR,DRYBULK SHIP,MUST "COINCIDENTALLY" REVISIT THE 25CENTS VERY IMPORTANT SUPPORT BROKEN DOWN AND BECOME RESISTANCE.

3)VIX WILL GO BELOW 15

4)DOW IN 2007 WAS MUCH HIGHER THAN 2000 BUT SP500 IN 2007 WAS SAME AS 2000.BUT THIS TIME WHEN SP500 GOES BACK TO 1576,DOW WILL REVIST THE 14200,VERY VERY "COINCIDENTAL".DOW FROM HERE 13000 TO 14200-10%,SP500 1410 TO 1576-11%

AFTER THAT TARGET BEING HIT=END OF 3RD HUMP,WILL COME A CORRECTION TO THE 1300-1380 REGION

THANK YOU

SHARESWIZARD

24th OCTOBER 2012-LAST NIGHT BDI SURGE LIKE FUCK PART 2!1 MONTH AND 12DAYS,BDI SURGE UP 68%!!

Baltic Dry Index

BDIY:IND

1,109.00 +72.00 +6.94%24th october 2012-PLEASE LOOK at my 23rd october post before us market open

the 1st upweek of the 9th 10+weeks uptrend pattern always start with

1)a mon-wed decline/flat,THEN A THURS/FRI SURGE OR A THURS AND FRI SURGE.

2)the weekly chart of 1st week up always has a lower tail of 1 to 2%

SO TONIGHT SP500 PLUNGE TO 1414 OR EVEN 1406 IS EXPECTED AS IT IS STILL IN THE DEFINITION OF 1ST WEEK UP IN SHARESWIZARD TERMINOLOGY,CAN YOU WITNESS HOW TRUE MY ALGORITHM IS?IS 1414 AND 1406,MY TARGETS VERY FAR FROM 1413 AND 1407?

in the end-

| 1,413 Last |

Today’s Change |

1,433.74 Today’s Open |

1,433.74 Day High |

1,407.56 Day Low |

552,734,000 Volume |

24th october 2012-IF THIS BOTTOM IM WRONG,AND GOES INTO CORRECTION,INSTEAD OF RETRACEMENT,WITHOUT GOING TO 1540-1576 1ST,PLEASE CALL ME A FUCKIN FAGGOT+I QUIT THE STCKMKT+PLEASE DELETE YOUR NAMES AS FOLLOWERS COZ IM NOT WORTHY

THANK YOU

YOURS SINCERELY

SHARESWIZARD

24th october 2012-I EXPOSE THE LIES OF THE MEDIA--nothing to do with funds going to hongkong to push up hangseng in september

I ALREADY SMS MY FRIENDS IN LATE AUGUST HANGSENG HAS A 10+% ARBITRAGE CHANCE AS STI AND SP500 HAS RUN AHEAD OF HANGSENG.

HOW DID I KNOW?

SP500 78.6% STANDS AT 1380

HANGSENG 50% STANDS AT 21300

STI 61.8% STANDS AT 2970

BY BEING AT 1430,3030,19000-SP500 IS 3+% FROM 1380,STI IS 2+% FROM 2970,HANGSENG IS -12% FROM 21300.

HENCE HANGSENG PLAY CATCH UP IN SEPTEMBER AND OCTOBER BY HAVING A MONSTER RALLY,BUT IT IS ACTUALLY PLAYING CATCH UP.

HENCE YESTERDAY,SP500 AT 1433,HANGSENG AT 21700,STI AT 3040-ALL REALINGNED TO +2-3% FROM THEIR RESPECTIVE FIBOS

STOCKMARKET IS ALL ABOUT MATHEMATICS.ONLY FOOLS AND IDIOTS USE NEWS TO BACK UP STOCKMARKET REACTIONS.THEY ARE SO INSECURE WITHOUT MY SP500 ALGORITHM THAT THEY SWAY WHEREEVER THE STOCKMARKETS BRING THEM,LIKE TOTAL INSTITUTE OF MENTAL HEALTH(IMH) PATIENTS.

TODAY,STOCKMARKET GOES UP ON BAD EARNINGS,IDIOTS WILL SAY QE3 HOPES INCREASE DUE TO BAD DATA

TOMORROW,STOCKMARKET GOES DOWN ON BAD EARNINGS,DATA,IDIOTS WILL SAY QE3 HOPES DIMINISH OR RECESSION FEARS ESCALATE!

A BIG FUCK YOU IF U BELIEVE IN NEWS.

24th october 2012-SEE MY 1406 HIT TODAY AND QUICK REBOUND UP!!AS AT 11.59 PM(SINGAPORE TIME),MISS BY 1 POINT!!

| 1,410 Last |

Today’s Change |

1,433.74 Today’s Open |

1,433.74 Day High |

1,407.56 Day Low |

178,000,000 Volume |

Tuesday, October 23, 2012

23rd october 2012-SP500 ALGORTIHM SO FIXED,S.O.P

the 1st upweek of the 9th 10+weeks uptrend pattern always start with

1)a mon-wed decline/flat,THEN A THURS/FRI SURGE OR A THURS AND FRI SURGE.

2)the weekly chart of 1st week up always has a lower tail of 1 to 2%

SO TONIGHT SP500 PLUNGE TO 1414 OR EVEN 1406 IS EXPECTED AS IT IS STILL IN THE DEFINITION OF 1ST WEEK UP IN SHARESWIZARD TERMINOLOGY

23rd october 2012-DID NOT SP500 HIT 1422 AND REBOUND UP STRONGLY???

PREDICTION MADE WAY BACK EARLIER-

MY 11TH OCTOBER 2012 POST-

3)"usa to have shallow retracement to 1422-1437 range in 2-4 weeks"

IN THE END,usa hit 1437 in the 2nd week,this week is the 4th week,revisit 1437,IF THIS WEEK DOES NOT REBOUND UP STRONGLY TO CLOSE NEAR 1474 ON FRIDAY,THEN NEXT WEEK,5TH WEEK OF RETRACEMENT,SP500 WILL HIT 1422 AND REBOUND UP STRONGLY"

http://data.cnbc.com/quotes/.SPX/tab/2

| 1,434 Last |

Today’s Change |

1,433.21 Today’s Open |

1,435.46 Day High |

1,422.06 Day Low |

511,793,000 Volume |

| Quotes delayed by at least 20 minutes | |||||

23rd OctoBER 2012-MY 1422 HAS BEEN HIT TODAY!!JUST LIKE IN MY SMS ON WEEKEND-MONDAY-WED,USMKT DROP TO 1400-1422,THURSDAY/FRIDAY SURGE UP TO 1460-1474

|

|

| Extended Hours | Unavailable Last Trade |

--- UNCH () |

Volume |

|

| 1422.49

Last Trade |

-10.70 (-0.75%) -10.70 (-0.75%) |

0 Volume |

1:48:05

PM EDT Trade Time |

Monday, October 22, 2012

22october 2012-IT IS CUMMING!!LET US SEE THIS WEEK,IS IT MON-WED DROP TILL 1400-1422,THURS,FRI SURGE TO 1460-1474,THEN THIS WEEK IS 1ST WEEK OF 9TH.VERYU EXCITING!IF IT IS,PLEASE DO ASK YOUR FRIENDS TO SUPPORT MY BLOG

3)"usa to have shallow retracement to 1422-1437 range in 2-4 weeks"

IN THE END,usa hit 1437 in the 2nd week,this week is the 4th week,revisit 1437,IF THIS WEEK DOES NOT REBOND UP STRONGLY TO CLOSE NEAR 1474 ON FRIDAY,THEN NEXT WEEK,5TH WEEK OF RETRACEMENT,SP500 WILL HIT 1422 AND REBOUND UP STRONGLY"

did you see although SP500 DID NOT HIT 1422 THIS MONDAY,IT DID HIT 1427,VERY NEAR 1422 AND REBOUNDED STRONGLY????????

HOW TO CONFIRM THIS WEEK IS THE 1ST WEEK OF THE 9TH 10+WEEKS OF USA UPTREND??

MUST WAIT TILL THIS FRIDAY NIGHT IN SP500-SP500 MUST,I MEAN MUST END THIS WEEK WITH A WEEKLY GAIN OF >+2% WEEKLY GAINS,END NEAR 1474-THIS IS THE SIGNAL OF THE 1ST WEEK OF THE 9TH.

THIS IS THE SP500 ALGORITHM.I MAJOR IN MATHEMATICS AND ECONOMICS SO I LOVE TO SPOT REPEATED ALGORITHMS.

Saturday, October 20, 2012

20th october 2012-AS EXPECTED,I TOLD YOU ALL WAIT TILL FRIDAY NIGHT TO SEE WHETHER IT IS 1ST UPWEEK OR RETRACEMENT TO CONTINUE.FRIDAY NIGHT PLUNGE TELLS US WE IN STILL IN RETRACEMENT-

I SUSPECT TODAY SP500 WILL CLOSE AROUND MY USUAL 1437,

PLEASE LOOK FOR NEXT WEEK---SP500 TO HIT 1422 AND A MAJOR REVERSAL IS IN STORE WHEN SP500 HITS 1422 AND CLOSE ON NEXT FRIDAY NEAR 1474.THAT WILL BE THE 1ST WEEK UP OF THE 9TH 10+WEEKS UP SIGNAL.

THANK YOU

YOURS SINCERELY

SHARESWIZARD

20th oct 2012

Friday, October 19, 2012

19TH OCT 2012-SEE THE "QUALITY" OF CFA,MBA

資金蜂擁投向中資股,在昨天二十大成交股份中,中資股及A股ETF便佔當中16隻,金額達212億元,利好港股撲向今年高位。

恒指漲102點 滙豐外圍穩

恒指6連升,創2月以來的最長上升期,高見21606點,距今年高位21760點相差約154點,歐股早段欠佳,遏抑恒指表現,收市升幅收窄至102點,收報21518點;國指亦突破5月7日下跌裂口,升144點,收報10636點;升市獲大成交配合,主板成交急增24%至709億元,沽空維持8.65%的低水平。

美國新申領失業救濟人數上升,美股午市反覆,但滙豐(00005)外圍造好,截至本港今晨4時,滙豐在美國掛牌的預託證券(ADR)折算報76.75港元,較港收市價76.45元高0.3元;中移動(00941)ADR折算報84.8港元,較港收市價85.1元低0.3元。

大摩轉軚 早前預期過於悲觀

摩根士丹利發表報告率先轉變看法,指早前預期實在過於悲觀,環球主要指數今年來升一至兩成,並認為過去審慎是錯誤的(we were wrong to be cautious),盈利預測下跌及估值(如PE,即市盈率)上升,是導致看錯原因,若PE上升大部分反映中央銀行的救市力度,然後預期政策干預將為後市帶來強勁支持,故企業盈利雖然有下跌風險,但未必對股市構成影響,更可以說,股市反彈,至少在已發展地區,可堅持至明年。

證券商均認為中國經濟見底,更普遍預期GDP反彈,大和證券指出,中國已開始復甦之路,預料第四季表現更佳,在救市措施發揮效用下,存貨將完成清減,預期第四季GDP將錄得反彈。

另外,繼續有企業趁市旺抽水,據銷售文件顯示,資本策略地產(00497)擬先舊後新方式,在市場配售8.86億股,配股價介乎0.33至0.35元,較昨日收市價0.395元折讓11.4%至16.5%,最多集資3.1億元。

更多經濟日報網站內容, 請登入hket.com

HAHA!! MORGAN STANLEY HIGHLY EDUCATED CFA,MBA,PHD SHITTY ANALYSTS IN REPORT:" WE WERE WRONG TO BE CAUTIOUS".

HAHAHAHAHA AT END OF THE DAY,SIMPLE PATTERN READING IS USEFUL OR SHITTY AND CONFUSING PHD,CFA,MBA??????

Thursday, October 18, 2012

18th october 2012-ANOTHER DAY,TODAY EVEN WORSE-SGX TURNOVER ONLY 10% HKEX!!

| HKEX HALF DAY TURNOVER VALUE-18th oct 2012

18/10/2012

| ||||||||||||

|

versus

sgx

Singapore Stock Market

| Thursday | ||

|---|---|---|

| *ST Index | 3,060.67 +15 | |

| Volume: | 660.9M | |

| Value: | $471.6M | |

| Gainers/Losers: | 178/135 | |

|

*As at 18-10-2012 12:04 PM

|

WHAT HKD 33,000MILLION??= SGD 5000 MILLION COMPARE TO SGX SGD NEAR 500MILLION??

WHAT?SGX TURNOVER 10% OF HKEX??FUCKING PATHETIC!!IS HK POPULATION 10TIMES OF SINGAPORE????

FUCKING CASH POOR,RATHER SPEND ON COE,IPAD,ETC

17th october 2012-detailed analysis of singapore property cycle with sibor link.-WHY CAN'T THOSE WHO BOUGHT PRIVATE CONDOMINIUMS/APARTMENTS IN 2011 THINK WITH THEIR ASSES?

AS YOU CAN ALL SEE FOR YOURSELVES THE DANGER OF SINGAPORE PRIVATE PROPERTY NOW.SIBOR IS FROM 1988 TO 2008,2000 TO NOW 2011(BLACK)AND PRIVATE RESIDENTIAL PROPERTY PRICE INDEX IS FROM 1993 TO 2012.

LET US TRACE THE DIFFERENT STAGES

STAGE 1:

FROM 1993 TO 1996,PRIVATE RESIDENTIAL PROPERTY INDEX ROSE FROM 80 TO 180,125% RISE,BUT SIBOR IN RANGE FROM 1+ % TO 4+% AND BACK TO 2% AT 1996.

STAGE 2:

FROM 1996 TO 1999 PRIVATE RESIDENTIAL PROPERTY INDEX CRASHED FROM 180 TO 100,A PLUNGE OF 50+%,THIS CORRESPONDS WITH SIBOR SHOOTING BACK UP TO 7+%.

STAGE 3: SHOWS THE 1ST WEAKNESS IN SINGAPORE PRIVATE PROPERTY.

FROM 1999 TO 2000,PRIVATE PROPERTY INDEX ROSE ONLY 40% FROM 100 TO 140 BUT SIBOR CRASHED FROM 7+% PEAK TO AROUND 2%

STAGE 4: SHOWS SECOND WEAKNESS IN SINGAPORE PRIVATE PROPERTY(I DONT THINK SARS HAS A PART TO PLAY,AS SARS ENDED IN MAY 2003)

Singapore free from SARS ban at end of month

Last updated at 15:58 30 May 2003The World Health Organisation (WHO) has announced that Singapore will no longer be on the list of countries affected by Sever Acute Respiratory Syndrome (SARS) from the 31 May.

After the Geneva-based health organisation confirmed the news, Singapore's health ministry responded by saying: 'It is a recognition of the comprehensive and rigorous measures that have been put in place in Singapore.'

Hong Kong and the Guangdong province of China were removed from the WHO's list with immediate effect earlier this week.

Read more: http://www.dailymail.co.uk/travel/article-590000/Singapore-free-SARS-ban-end-month.html#ixzz29Zd153ou

FROM 2000 TO 2005.SIBOR MADE A NEW LOW,GOING TO BELOW 1%,BUT PRIVATE PROPERTY INDEX INSTEAD OF GOING UP,ALSO WENT DOWN FROM 140 TO 110

STAGE 5: SIMILAR TO STAGE 1,SIBOR STUCK IN A RANGE BUT THE GAINS IN PRIVATE PROPERTY INDEX WAS MUCH LESSER THAN THE STAGE 1'S 125%,ONLY AROUND 50%,SHOWING SIGNS OF "UNAFFORDABILITY"

FROM 2005-2008,PRIVATE PROPERTY INDEX ROSE MORE THAN 50%,ALMOST HITTING THE 1996 PEAK.SIBOR STUCK IN 1+% TO 3+% RANGE AND DROPPING BACK DOWN TO 1+% RANGE IN 2008.

STAGE 6:SHOWS THE 3RD WEAKNESS IN SINGAPORE PRIVATE PROPERTY

USA SUBPRIME CAME AND IT WAS JUST A KNEE JERK REACTION FOR SINGAPORE PROPERTIES AS THE GOVERNMENT SLASHED INTEREST TO NEAR ZERO.PRIVATE PROPERTY INDEX DROPPED FROM 180 TO NEAR 140 AND REBOUNDED TO THE CURRENT 200s.

IN THE FACE OF STRONG GDP,AND RECORD LOW SIBOR AT NEAR ZERO,A REDUCTION OF AROUND 3% POINTS FROM 1996 PEAK IN HOUSING INDEX,THE HOUSING INDEX WAS ONLY MARGINALLY HIGHER THAN THE 1996 PEAK,AROUND +10%.

3 signs of SLUGGISHNESS in private property index.IF ECONOMY IS REALLY THAT STRONG,AND SIBOR NEAR ZERO,SHOULD NOT PRIVATE PROPERTY INDEX ROCKET 30-50% HIGHER THAN 1996?WHY IS IT SO SLUGGISH AT THE DOUBLE TOP??

QUESTIONS ASKED:

1)WHO IS SO STUPID TO LOAN YOU 6 OR 7 DIGITS PROPERTY LOANS AT 1+% PROPERTY LOAN INTEREST AND WHEN THE ECONOMY IS SO STRONG??SHOULD NOT ADULTS QUERY THERE MIGHT BE A HIDDEN AGENDA??WHY CANT BANKS SAVE THE 6,7 DIGITS LOAN AND USE THE MONEY FOR THEMSELVES TO BUY UP PROPERTIES AND EARN??

Q2)WHO IS SO FUCKING STUPID TO GO INTO PRIVATE PROPERTIES AFTER PROPERTY STOCKS LIKE CAPITALAND CRASHED FROM S$8+ TO AROUND S$2+,CDL 17 CRASH T0 4?STOCKMARKET IS A FORWARD INDICATOR ABOUT THE ECONOMY.IT IS NOT A PURE GAMBLING PLACE.

till today,capitaland is still at S$3+ AND CDL IS BETTER AT S$11.BOTH ARE STILL BEHIND THE STI,MAIN INDEX is only 30% from all time max3906,capitaland is 160% away from $8+,CDL is 50% away from $17+.

Q3)with sgd at record high,SIBOR AT RECORD LOW,SINGAPORE ECONOMY,WHICH I EXPECTED LONG TIME AGO,TO slip into negative growth,HAS FINALLY DONE IT IN Q3 2012-A TRIPLE WHAMMY IS IN STORE for private property owners WHO ENTERED LATE INTO THE GAME.

im a econs major also,other than a mathematics major.singapore is "beseiged" with low gdp,and high inflation problems currently in 2012.WITH USD KEEP ON GOING DOWN AGAINST THE SGD,SO WILL SINGAPORE GDP.THIS WILL CREATE A DOUBLE PROBLEM.USD KEEP ON GOING DOWN WILL ALSO CREATE INFLATION IN SINGAPORE.SIBOR CAN ONLY SWIM AROUND HERE OR GO UP.

LOW GDP + HIGH INFLATION = AINT THAT STAGFLATION SCENARIO coming?

the future of singapore looks bleak from economic point of view-MAS has limited policy tools in hand as SIBOR IS SO LOW now.plus usa fomc says they may raise interest rates in 2015.

THOSE WHO BOUGHT IN STRONG ECONOMY AND LOW INTEREST RATES ARE JUST ASKING FOR TROUBLE TO BE DELIVERED TO THEIR DOORSTEP--THEY NEVER ASK THEMSELVES WHAT IF BOTH TURN AGAINST ME????

BETTER BEWARE AS THE ROAD AHEAD FOR SINGAPORE PRIVATE RESIDENTIAL PROPERTIES AIN'T ROSY,YES LONGTERM SINGAPORE PROPERTIES SURE IS UP BUT WHY RUSH INTO IT AFTER SURGED NEAR 150% IN 20YEARS,WITH SIBOR PLUNGING FROM 8% TO NEAR 0%?

WHAT IF SIBOR WENT BACK UP TO 8%(IT HAPPENED BEFORE IN ASIAN FINANCIAL CRISIS)???

WHAT IF SGD GOES TO PARITY WITH US$?

THIS WILL DEAL A MASSIVE BLOW TO GDP AND EMPLOYMENT,WHICH IN TURN WILL DEAL A MASSIVE BLOW TO PRIVATE PROPERTIES AS THIS CLASS IS A SALARY RICH BUT ASSET POOR CLASS GAME.THIS CLASS IS A HEAVILY LEVERAGED CLASS,UNLIKE THE GOOD CLASS BUNGALOWS CLASS WHICH ARE OWNED BY THE REALLY ASSET RICH PEOPLE.

Wednesday, October 17, 2012

17th october-LINKING BDI AND CHINA TOGETHER TELLS ME AND YOU ALL A VERY REVEALING STORY!!

this is the bdi chart from 1985-2011,i download from other websites.AS YOU CAN SEE BDI HAS A CLOSE CORRELATION WITH CHINA.

THE BDI SURGE FROM 2005 ONWARDS WAS 6X,600% FROM 2000 TO NEAR 12000,THAT WAS EQUAL TO SHANGHAI SURGE FROM 1000POINTS IN 2005 JUNE TO 6200 IN 2007,ALSO 600%.SHANGHAI NOW IS AT 2000,NOT 1000,HENCE BDI AT 981 IS RIDICULOUSLY UNDERVALUED!!!!the true bdi value when shanghai at 2000 points now should be around 4000points.

in summary:

1.SOMETIMES,BDI IS A FORWARD INDICATOR,RALLIED 1ST IN 2001 T0 2005,and AHEAD OF SHANGHAI COMPOSITE,FROM 1000 TO 5000,DESPITE SHANGHAI COMPOSITE DROPPING,THEN BACK DOWN TO 2000 TO SET THE "LAUNCHING BASE" TO TALLY WITH SHANGHAI COMPOSITE 1000 TO 6000POINT SURGE.

STAGES

1)Shanghai composite 1994-2001 surge from 325 to 2245 VS BDI START DROP IN 1995 TO 2001,2500 TO ARD 1000.

2)SHANGHAI COMPOSITE THEN STARTED TO DROP FROM 2001 TO 2005,REFLECTING BDI DROP FROM 1995 TO 2001,2200 POINTS TO 1000POINTS ROUGHLY SIMILAR TO BDI DROP FROM 2500POINTS TO 1000POINTS.

BUT BDI DURING THIS PERIOD SURGED FROM 1000 TO 5000,THEN BACK DOWN TO 2000.

3)SOMETIMES IT IS IN TANDEM WITH SHANGHAI 1000-6000+,BDI 2000-NEAR 12000 FROM 2005 TO 2007.

in conclusion,BDI IS DEFINITELY A CHINA PLAY BUT SOMETIMES IT RUNS AHEAD OF CHINA,SOMETIMES IT IS IN TANDEM WITH CHINA.

17th october 2012-OH MY GOD!! BDI SURGE LIKE FUCK AGAIN!! YESTERDAY +4.2%.ONE MONTH AND 5 DAYS +50%!!!!WHAT THE FUCK?!!!

Baltic Dry Index

BDIY:IND

981.00 +40.00 +4.25%17th october 2012-MY 11TH OCTOBER POST WAS SO SO TRUE!!BUT MUST WAIT TILL FRIDAY TO CONFIRM

3)"usa to have shallow retracement to 1422-1437 range in 2-4 weeks"

IN THE END,usa hit 1437 in the 2nd week,this week is the 4th week,revisit 1437,IF THIS WEEK DOES NOT REBOND UP STRONGLY TO CLOSE NEAR 1474 ON FRIDAY,THEN NEXT WEEK,5TH WEEK OF RETRACEMENT,SP500 WILL HIT 1422 AND REBOUND UP STRONGLY"

did you see although SP500 DID NOT HIT 1422 THIS MONDAY,IT DID HIT 1427,VERY NEAR 1422 AND REBOUNDED STRONGLY????????

HOW TO CONFIRM THIS WEEK IS THE 1ST WEEK OF THE 9TH 10+WEEKS OF USA UPTREND??

MUST WAIT TILL THIS FRIDAY NIGHT IN SP500-SP500 MUST,I MEAN MUST END THIS WEEK WITH A WEEKLY GAIN OF >+2% WEEKLY GAINS,END NEAR 1474-THIS IS THE SIGNAL OF THE 1ST WEEK OF THE 9TH.

THIS IS THE SP500 ALGORITHM.I MAJOR IN MATHEMATICS AND ECONOMICS SO I LOVE TO SPOT REPEATED ALGORITHMS.

THANK YOU

YOURS SINCERELY

SHARESWIZARD

17th oct 2012-SO OBVIOUS BDI HAS HIT FINAL BOTTOM.compare between many drybulk stocks,YOU WILL SEE MANY HIT DOUBLE BOTTOM WITH 2009 WHEN SOME LOUSIER ONES WENT EVEN LOWER THAN 2009-THIS IS SHARESWIZARD MOST IMPORTANT DIVERGENCE SIGNAL OF FINAL BOTTOM/TOP!!

BELOW ARTICLE WAS CUT AND PASTE FROM-http://seekingalpha.com/article/926511-how-to-play-a-bottom-in-drybulk-stocks?source=cnbc

How To Play A Bottom In Drybulk Stocks

Business relationship disclosure: The article has been written by Qineqt's Industrial Analyst. Qineqt is not receiving compensation for it (other than from Seeking Alpha). Qineqt has no business relationship with any company whose stock is mentioned in this article.

BDI components:

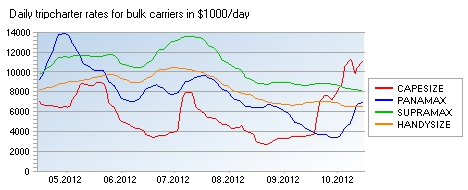

As mentioned in our earlier articles, BDI is formed of weighted averages of charter rates of Capesizes; Handymax, Supramax and Panamaxes. Each vessel size has its own index (BCI, BHSI, BSI and BPI). These averages then make up the BDI. The following shows the daily trip charter rates for different vessels:

Following shows the change in the indices on 15th October.

| Indices | Index value | Change |

| Handysize | 6536 | +1 |

| Capesize | 11074 | +703 |

| Panamax | 6937 | +221 |

| Supramax | 8110 | -82 |

The index for Panamax has also risen. Panamax are used to transport coal. The demand has strengthened after the coal inventories at the Chinese power stations declined. A Panamax normally carries 60,000 tons of coal. Demand gained after the stock of coal at port of Qinhuangdao reached 5.5 million tons, 1.5 million tons short of the government target of 7 million tons. Again, the same question needs to be answered, how much of the demand is temporary? In an earlier article, we mentioned that China imports excess coal in the third and fourth quarters as freezing temperatures disrupt the activity at ports for the next three months. Having said that, it is also important to remember that China is planning to increase its electricity generation in the country, therefore, the hike in demand may not be temporary after all.

Conclusion:

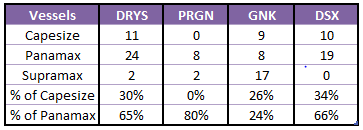

The table above shows the number of Capesize and Panamax that each company has in its fleet. Where DryShips (DRYS) and Diana Shipping (DSX) have the larger number of Panamaxes and Capesizes, Genco Shipping (GNK) and Paragon Shipping (PRGN) also have exposure to coal.

All these stocks are expected to benefit from the rise in coal and steel activity. The bulkers that trade purely on BDI will be the major beneficiary from the surge in BDI. Baltic Trading (BALT) and FreeSeas (FREE) are the bulkers that are a pure play on BDI. Also, most of DRYS' Panamax fleet is on spot charters. However, in the long-run, all bulkers will benefit in case the rise in BDI is sustained.