SINOPEC TRADING IN A $2 BAND,BROKE DOWN,TARGET $6.BUT IT WILL FIRST REVISIT THE $8 RESISTANCE BEFORE THE 3RD HUMP IN USA ENDS,WHERE IT WILL GO DOWN AND HIT THE $6 TECHNICAL TARGET.

TECHNICALS WEAK.

SINCE THIS THREAD "SUMMARY OF ALL SP500 UPTRENDS AND CONSOLIDATIONS" THREAD IS SO POPULAR,THE HIGHEST VIEWERSHIP,I PUT IT IN THE FRONT PAGE

SUMMARY OF ALL SP500 uptrends and consolidations

UPTRENDS-

1. Mostly 10weeks,although some may be 9,11,12.how to recognize?--uptrend "mysteriously" maintained by a diagonal uptrendline connecting the lows of that 10weeks uptrend

2. 1st and last(10th) week always end in surges of aorund 3-6%with the least 1st week gain was 2.7%.The humpy uptrend will "mysteriously" start and end with surges up.

3. If the (X-1)th 10+weeks end below a fibo of the 1576-666 range,THEN the next,Xth, 10+weeks will end AT THAT FIBO.

4. If the (X-1)th 10+weeks end ABOVE a fibo of the 1576-666 range,then the NEXT,Xth, 10+weeks will end AT THE NEXT HIGHER FIBO.

5. Every year's end, at the last trading day of the year,sp500 will end near a fibo of 1576-666 range.

6. Every 10+weeks uptrend will start AFTER a double testing of the diagonal uptrend line formed by the humps from july 13th week 2009.

7. The uptrend in the secular bear market,before breakout 1576, will be a "humpy" ride,whereby i forecast a total of 4 humps to test 1576.

8. After the sp500 breaks out of the 1576 resistance,the diagonal uptrendline will be much sharper than the uptrendline of the 4 humps.

9. The peaks of each hump will occur at AROUND 350-360 POINTS ABOVE THE CORRECTION TESTED FIBONACCI.

10. 2009 REPLICATE 2003,2010 REPLICATE 2004,2011 REPLICATE 2005,SO ON--I mean the closing values and their respective fibo,

CONSOLIDATIONS-CORRECTIONS AND RETRACEMENTS

1. Every correction will have one week of huge plunge about 100points in sp500

2. every Long/HUGE weekly plunge of around 5-8% in the sp500 will be met with a return to the start BEFORE the huge plunge(weekly open) of THAT LONG WEEKLY DOWN CANDLEBODY in 23 to 24 weeks

3. After the peak of each hump has been achieved,there will come a plunge BACK to the fibo of 1576-666 range.---------

eg. 1st hump ended at 1219,near 61.8%,then sp500 plunged back to retest the 38.2%,before the NEXT hump will be formed

eg. 2nd hump peaked at 1370,near the 78.6%,then sp500 plunged back to retest the 50%..so on..

1st correction went to the 38.2%,1013, lowest 1010 and built a base around 1065

-took 24 weeks to reach the open of the HUGE weekly plunge of 120points,week of MAY 3RD 2010

-dropped a total of 210points-2nd week from the top of the 4th 10+weeks uptrend pattern 1217,was the huge weekly plunge

-took 8weeks to hit the lowest point 1010

2nd correction went to 1074 lowest,BUT built a base around the 50% fibo,1120.

-took 23 weeks to reach the open pf the 2nd HUGE weekly plunge of 120points,week of August 1, 2011

-dropped a total of 270points from 1344 and 300points from the HEAD peak 1370

-the huge weekly drop also happened in the 2nd week from the 5th 10+weeks uptrend pattern close peak of 1344.,the LEFT SHOULDER OF THE head and shoulders

-took 9weeks to hit the lowest point 1074

THIS IS THE NEW AND IMPROVISED VERSION OF THE MOST POPULAR POST IN MY BLOG

LET US RECALL THE LIES OF MEDIA OR PEOPLE WHO DON'T KNOW HOW TO EXPLAIN

1)DATA GOOD,COMPANIES EARNINGS GOOD,INDEX DROP= "FACTORED IN" OR "LESSEN STIMULUS HOPES"

2)DATA BAD,COMPANIES EARNINGS BAD,INDEX RISE="INCREASED STIMULUS HOPES"

3)WHEN USA CRISIS CAME,FULL OF CDO SHIT PROBLEM,NO1 KNOWS THERE WILL BE A EUROPE CRISIS IN 2009.THEN CAME EUROPE CRISIS.

4)WHEN EUROPE CRISIS BECOME STALE NEWS,FOCUS SHIFT TO LIBYA GADDAFI TO "EXPLAIN" DROP IN USA MARKETS

5)THEN AFTER GADDAFI NEWS BECAME STALE,THEY SHIFT BACK TO EUROPE AND CHANGE TO "AUSTERITY" SHIT

6)THEN AFTER EURO AUSTERITY NEWS BECOME STALE,THEY SHIFT FOCUS BACK TO USA AND INTRODUCED "FISCAL CLIFF" SHIT JUST BECAUSE BERNANKE MENTIONED FISCAL CLIFF

I "LOVE" THEIR SHIT.EVERYTIME THE STORY BECOMES OLD AND STALE,SOMETHING NEW WILL POP OUT AND THE OLD ONE WILL NEVER BE MENTIONED AGAIN-SINK INTO OBLIVION!!

1ST CDO,LIBYA,AUSTERITY,NOW FISCAL CLIFF.NEXT FUCK YOU!!DID CDO SHIT RESURFACE AGAIN NOW?WHO REMEMBER GADDAFI,LIBYA PROBLEMS SUDDENLY SOLVED FOREVER??

GRANDMOTHER STORY SPINNERS FUCKERS.

19th October 2013

NEPTUNE ORIENT LINES ROBOTIC PATTERN

1) BASE

A-

WEEK oF 17 NOVEMBER 2008—0.93

Week of 9 March 2009—0.85

DOUBLE BOTTOM HIT

3+ MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED +182% IN

1YEAR,1 MONTH, HIT NEAR 2.40 IN APRIL 2010

2) BASE

B-

Week of 22 August 2011—0.98

Week of 21 November 2011---0.995

DOUBLE BOTTOM HIT

3 MONTHS APART BETWEEN

1ST AND 2ND BOTTOM

RALLIED +53% IN 3

months.HIT 1.515 IN 20 FEBRUARY 2012 WEEK

3) BASE

C-

Week of 23 July 2012—1.05

Week of 19 November 2012---1.05

DOUBLE BOTTOM HIT

3+ MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED +30% IN 1.5months.HIT

1.36 IN 7 January 2013 WEEK

4) NOW,IT

IS BASE D TIME

Week of 10 June 2013—1.025

Week of 26 August 2013---1.025

DOUBLE BOTTOM HIT

Near 3 MONTHS APART

BETWEEN 1ST AND 2ND BOTTOM

RALLIED ????% by

??????

N.O.L-NEPTUNE ORIENT LINES-N03.SI (WEEKLY CHARTS) YEAR 2006:6 NOVEMBER TO 1ST JAN2007: 1.77 TO 2.20 (+43c) YEAR 2008:17NOVEMBER TO 5JAN2009: 0.84 TO 1.175 (+33.5c) YEAR 2009:2NOVEMBER TO 11JAN2010: 1.51 TO 1.94 (+43c) YEAR 2010:22NOVEMBER TO 3JAN2011: 2.07 TO 2.40 (+33c) YEAR 2011:21NOVEMBER TO 30JAN2012: 0.995 TO 1.43 (+43.5c) YEAR 2012:19NOVEMBER TO 7JAN2013: 1.055 TO 1.36 (+30.5c)

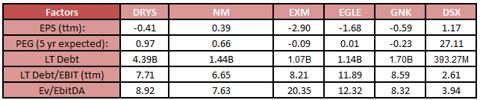

Eagle Bulk Shipping Inc( EGLE :NASDAQ)

*

Real Time Stock Quote

Data is delayed

Source: NASDAQ Real-Time Last Sale

|

| Extended Hours | Unavailable Last Trade |  0.07 (+1.96%) 0.07 (+1.96%) | 1,700 Volume | 09:28:00 AM EDT |

| 3.8272 USD Last Trade |  0.2572 (+7.2%) 0.2572 (+7.2%) | 179,797 Volume | 11:49:38 AM EDT Trade Time |

DryShips Inc( DRYS :NASDAQ)

*

Real

Time Stock Quote

Data is

delayed

Source: NASDAQ

Real-Time Last

Sale

|

| Extended Hours | Unavailable Last Trade |

0.16 (+6.43%) 0.16 (+6.43%) |

121,057 Volume |

09:29:51

AM EDT |

| 2.6745 USD

Last Trade |

0.1845 (+7.41%) 0.1845 (+7.41%) |

5,955,235 Volume |

11:51:15

AM EDT Trade Time |

By Romesh Navaratnarajah:

By Romesh Navaratnarajah:

MediaCorp to move to Mediapolis@one-north Buona Vista | ||||||

|

| ||||

| inShare0 | ||||

|

| ||||

| Written by Gwyneth Yeo |

| Monday, 26 March 2012 23:34 |

|

CapitaMalls Asia is opening The Star Vista, the first major mall in Buona Vista in more than 30 years, in September. The mall has already signed key tenants and will offer extended operating hours, al fresco dining options and more than 800 car park lots. It will have a total of 110 shops from Basement 1 to Level 2, with more than 50% of its net lettable area allocated for F&B.

Some of the new dining concepts to be offered include cafés such as Jamaica Blue and Owl Café, Boston Seafood Diner, Senor Taco and Porn’s, a Thai restaurant opened by local celebrity Pornsak. Right above the mall is The Star Performing Arts Centre, owned and managed by Rock Productions, which will contain a 5,000-seat theatre and one of the largest performance venues in Singapore, fully equipped to host concerts, dance and musical performances.

|